The Sensex falls 143 points because to continued foreign money outflows and negative global trends.

The Sensex falls 143 points because to continued foreign money outflows and negative global trends.

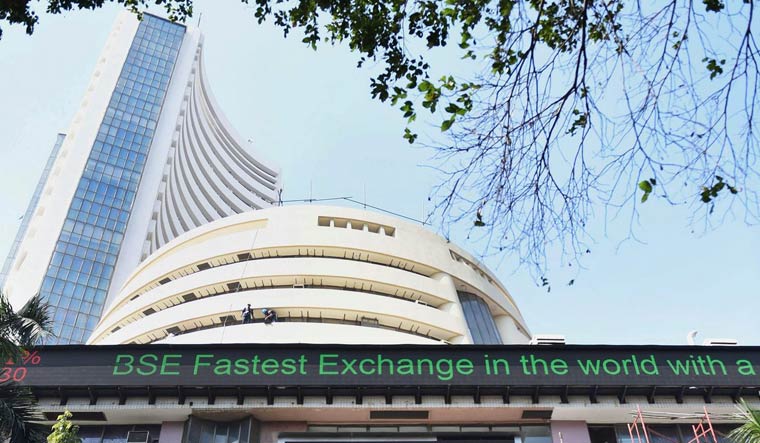

The benchmark Sensex fell 143 points on Thursday due to ongoing foreign money withdrawals and conflicting global market patterns.

The 30-share BSE Sensex fell 143.41 points, or 0.22 percent, to close at 64,832.20 in turbulent trade. It slid 206.85 points, or 0.31 percent, to 64,768.76 during the day.

The Sensex fell 48.20 points, or 0.25 percent, to 19,395.30.

The main laggards on the Sensex were Hindustan Unilever, Tech Mahindra, Infosys, Reliance Industries, Bajaj Finance, Tata Consultancy Services, Titan, and UltraTech Cement.

Among the winners were Mahindra & Mahindra, Power Grid, IndusInd Bank, Tata Motors, Larsen & Toubro, and Maruti.

In Asian markets, Seoul, Tokyo, and Shanghai finished up, while Hong Kong finished lower.

The majority of European markets were trading in the green. On Wednesday, the US markets ended on a mixed note.

The Indian market is stuck in a range-bound trend, reflecting the mixed global emotions, with the Nifty index failing to break above the critical level of 19,500. “While FII selling has slowed, inflows have remained subdued due to concerns about rising interest rates and a global slowdown,” said Vinod Nair, Head of Research at Geojit Financial Services.

Brent crude rose 0.99% to $80.33 a barrel, the global oil benchmark.

According to market statistics, foreign institutional investors (FIIs) sold securities worth Rs 84.55 crore on Wednesday.

On Wednesday, the BSE benchmark rose 33.21 points, or 0.05 percent, to 64,975.61. The Nifty rose 36.80 points, or 0.19 percent, to 19,443.50.